Bridge Logistics Sales Director, Chris Seeds, discusses his previous predictions of freight markets trending downward.

Back in November of last year we put out an episode of What Not To Miss with Chris titled “Signs of Cooling,” where we looked at a number of indexes that were signaling a concern for a gradual softening within the freight market at some point in 2022. Few advisors, myself included, could have predicted the speed of easing at which we’ve seen take place within the market over the past 30 days. Let’s take a quick look at what’s transpired and then jump into the WHY behind the what.

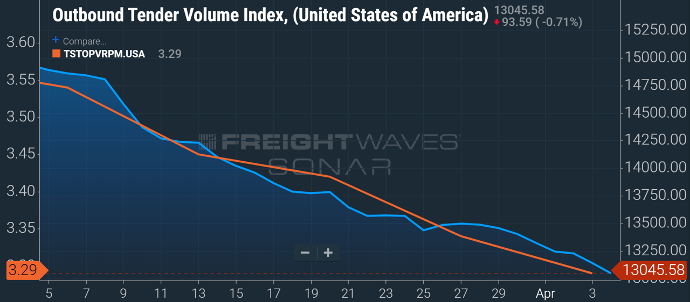

Over the past 30 days there has been a noteworthy decline in tender volumes (over 12% to be exact). And as tenders have fallen over the past 30 days, the national average for spot rates has, too (according to Truckstop.com). Putting holidays aside, we have not seen a deterioration of this magnitude over a short period of time since the beginning of COVID.

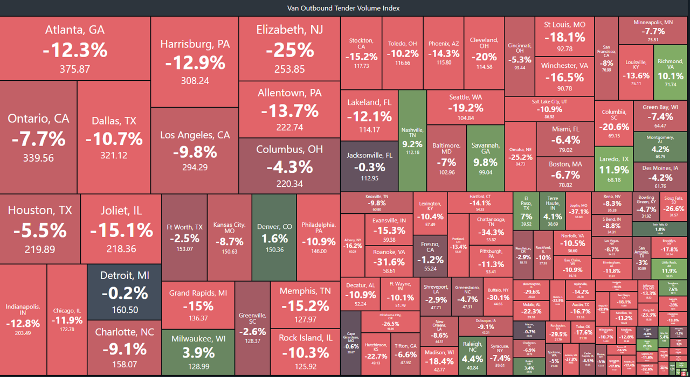

What’s interesting is the speed at which this volume decline over the past month has taken place: out of DAT’s 135 monitored freight markets, 114 are posting falling volumes. Even some of the largest markets in the nation like Atlanta, Harrisburg, Dallas, and Allentown are experiencing double-digit volume decay over the past month. So now that we’re all up to speed on what’s going on, let hone in on WHY this is happening. To start, let’s talk about inventory levels. To help me explain why increasing inventory levels are having a substantial impact on TL volumes, I pulled out a brief summary from February’s LMI report.

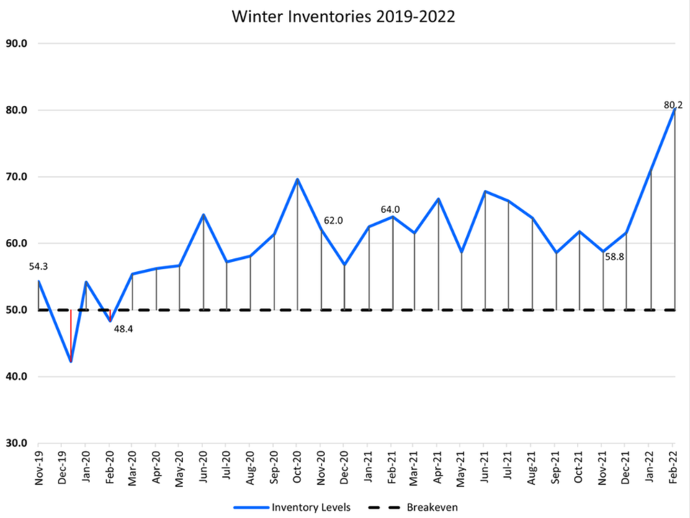

The report states that “like January, this month’s growth is driven by rapid growth in Inventory Levels, which are up 9.1 points to 80.2 – crossing the 80.0 threshold for the first time and shattering the previous record of 72.6. This is a complete 180 from the Fall of 2021, when firms struggled to build up inventories. Now, it seems that a combination of over-ordering to avoid shortages, late-arriving goods due to supply chain congestion, and a softening of consumer spending has created a logjam. Inventory Levels are a full 21.4 points higher than they were in November.”

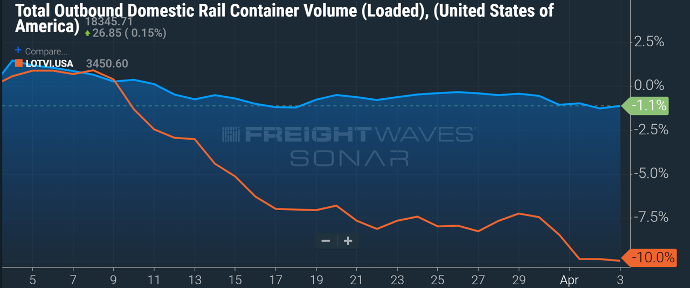

The report goes on to talk about how the increase in inventory levels has also caused inventory costs to “reach a new peak.” Now it’s important to remember that one of the primary reasons freight costs began rising at the beginning of the pandemic was due to the speed at which consumers were demanding goods to be delivered. Rail, for some time, not only struggled to rebuild its workforce to meet demand, but transit times due to unprecedented congestion levels left truckload a much more viable option for shippers.

That being said, Domestic intermodal volumes (blue) typically tracks closely with long-haul truckload volumes (orange). Domestic outbound loaded rail volumes have remained relatively flat over the past 30 days while long-haul truckload volumes have decreased by 10%. I find this interesting as inventory concerns seem to be diminishing, inflation costs (including fuel) continue to increase, and retail sales have started to wane. My final point surrounds the substantial increase in For-Hire Fleets that have been injected into the market over the past year. The amount of New Fleets authorized for hire has nearly doubled since February of last year – smashing every historical record on file.

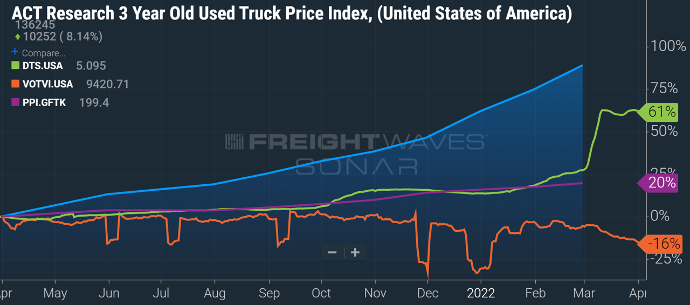

The vast majority of these new entrances being fleets with 1-6 trucks; which matters as small fleets lack the fuel buying power of large carriers and entered into the market during a period when new and used truck costs, labor, insurance and maintenance expenses have all caused the producer price index for general freight trucking over the past year to increase 20%. Now, tack on a 16% decrease in van volumes year-over-year and you end up with the majority of these new fleets fighting over a much smaller pool of freight and pushing down spot rates, all while trying to cover above average overhead costs.